How to Lay a Complaint with the FSCA

The Financial Sector Conduct Authority (FSCA) is South Africa’s financial watchdog. Its role is to ensure that financial institutions such as banks, insurers, investment firms, and financial advisers treat customers fairly and follow the law.

If you believe a financial services provider (FSP) has acted unfairly, misled you, or broken regulations, you can lodge a complaint with the FSCA.

Here’s how the process works.

Step 1: Try to Resolve the Issue with the Institution First

The FSCA requires that you first give the financial institution or adviser a chance to resolve your complaint.

- Contact their complaints department in writing (email or letter).This should be provided at inception of the policy.

- Keep copies of all correspondence, contracts, or policies.

- Most providers must respond within 6 weeks under the Financial Advisory and Intermediary Services (FAIS) Act.

If you are not satisfied with the response—or receive no response—you can then escalate the matter to the FSCA.

Step 2: Lodge the Complaint with the FSCA

You can file a complaint directly with the FSCA through one of these channels:

- Online: Submit via the FSCA’s complaints portal on their website.

- Email: Send details to complaints@fsca.co.za.

- Post: FSCA Complaints Department, P.O. Box 35655, Menlo Park, Pretoria, 0102.

- Walk-in: Visit the FSCA offices in Pretoria.

Information You Must Provide:

- Your full name and contact details.

- The name and FSP number (if known) of the institution/adviser.

- A clear description of the complaint.

- Supporting documents (contracts, statements, emails).

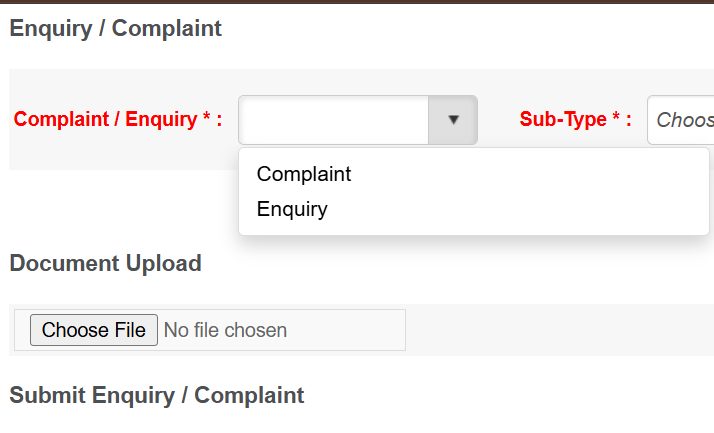

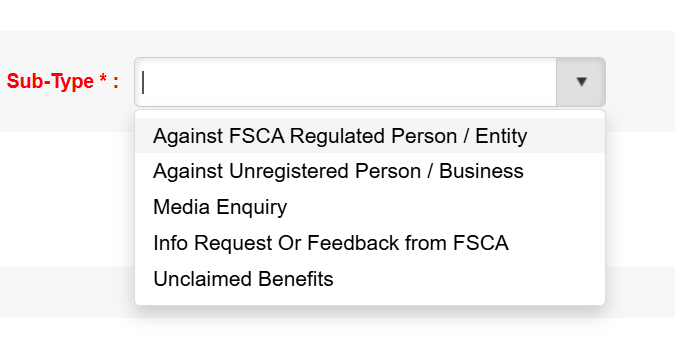

Via the website you are able to choose if it is a ‘compliant ‘ or ‘enquiry’ as well as if it is against a unregistered or registered FSCA regulated entity or person as well as other areas of enquiry.

Step 3: FSCA Acknowledgement and Review

- Once received, the FSCA acknowledges your complaint within 7 working days.

- They will assess whether your complaint falls under their mandate. If it relates to contractual disputes (e.g., how much a claim should pay out), they may refer you to the Ombud for Financial Services Providers (FAIS Ombud) or another industry Ombud.

- If the FSCA investigates, they will contact the financial institution and request a response.

Step 4: FSCA Decision or Referral

- Institutions are usually given 21–30 working days to respond to the FSCA’s request.

- The FSCA then reviews the response, considers the facts, and informs you of the outcome.

- If misconduct is found, the FSCA may:

- Order the FSP to take corrective action.

- Issue fines, warnings, or suspend the licence.

- Refer systemic issues for further regulatory action.

You will always be notified in writing about the FSCA’s decision or next steps.

When can you complain ?

Here are some scenarios in which you are able to file a complaint

- Unlicensed Adviser: You discover that someone posing as a financial adviser sold you a fake investment.

- Misrepresentation: An insurer failed to disclose exclusions in your policy. T

- Overcharging Fees: A financial planner charged hidden fees.

How Long Does It Take?

The overall process can take 30–90 days, depending on the complexity of the case. Straightforward matters are resolved faster, while systemic investigations may take longer.

Leave a Reply