Who is the FSCA ?

The Financial Sector Conduct Authority (FSCA) is South Africa’s financial watchdog. Its job is to make sure that banks, insurance companies, investment firms, and financial advisors play fair and treat people honestly. When businesses or individuals break the rules, the FSCA steps in with different tools to protect the public.

Warnings

A warning is an alert to the public. The FSCA issues warnings when it finds companies or people offering financial services without the proper license. For example, someone might pretend to be an investment advisor when they are not registered. ( The Forex Trader)

- Timeframe: Warnings are often issued quickly, sometimes within days of the FSCA confirming that an entity is unlicensed.

Notices

A notice is an official communication from the FSCA. It can explain rules, set deadlines, or remind financial companies about their duties. Some notices apply to the whole industry, while others target specific businesses.

Notices usually give companies a deadline to respond — often 14 to 30 working days, depending on the issue.

Fines (Administrative Penalties)

If a company or person breaks the law — such as lying to customers, selling products without a licence, or failing to report important information — the FSCA can issue a fine. These are called administrative penalties. The size of the fine depends on how serious the wrongdoing is.

The FSCA typically gives the business or person a chance to explain themselves (this is called “representations”) within 30 days before making a final decision. Once a decision is made, the fine is published.

Punishments (Sanctions)

Besides fines, the FSCA the other forms of ‘Punishment’ or ‘ Sanction’ they are able to impose on wrongdoers.

Debarment: banning a financial advisor or broker from working in the industry.

Suspension or withdrawal of license’s: stopping a company from offering financial services.

Criminal referrals: if the offence is serious, the FSCA can hand the case over to the police or prosecutors.

Where you can find this info –

The FSCA believes in transparency. This means the public can freely access:

- Lists of warnings against fake or unlicensed operators (updated as soon as issued).

- Media releases about fines and punishments (usually published within days of the decision).

- Official notices that explain rules and expectations.

- Annual reports showing statistics on fines, bans, and enforcement actions.

All of this is available on the FSCA’s website: www.fsca.co.za.

Lets Navigate.

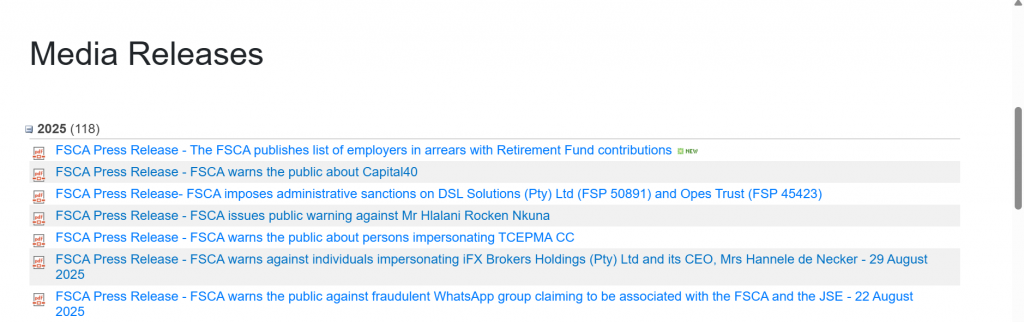

On the Homepage of the FSCA website , you will find ‘Media Releases’.

To Navigate Media Releases just click the small + next to 2025 and it will expand the 2025 tab and display all the media releases for the year 2025.

Further down on the homepage you will find ‘ Warnings and Alerts’ ,’Notices’, ‘Complaints and compliments’.

Why It Matters

The FSCA’s enforcement protects ordinary South Africans from scams, unfair treatment, and financial harm. By making its actions public, and by setting clear timeframes for decisions ,the FSCA helps people make safer choices about who they trust with their money.

Leave a Reply